Multi-Campus Collaboration Kickstarts Solar Project to Cut 100% of GHG Emissions from Electricity

Dickinson College, Lafayette College, Lehigh University, Muhlenberg College, Coho Climate Advisors

Project Overview

Four independent colleges and universities in Pennsylvania collaborated to explore renewable energy solutions, develop a strategy, and implement a combination of onsite and large-scale offsite projects that will result in each institution sourcing 100% of their electricity from renewable sources.

Background

In 2017 and 2018, several groups of campuses throughout Pennsylvania actively explored and discussed collaborating to achieve better economies of scale for sourcing renewable energy from utility-sized solar and/or wind projects. Individual campuses attended workshops and webinars, and talked informally as peers exploring renewables in parallel.

In September 2018, Lehigh University contracted CustomerFirst Renewables (CFR) to develop a comprehensive renewables strategy. At the same time, several other schools were exploring a similar route with the same advisor. Given their similar interests and timing, and their close proximity to one another, the campuses decided to collaborate as a cohort, including Lehigh, Muhlenberg, and Lafayette, to jointly pursue large-scale renewable energy.

The core group established key aggregation alignment considerations so that additional campuses could consider joining the effort. The criteria included:

Timing – will your campus be able to join the effort without slowing it down? Contract tenor – can your campus agree to a 20 year contract? Location – does your campus have a requirement, versus preference, for project location?

Over several months, many schools expressed interest and participated for brief periods, and Dickinson formally joined the cohort.

Goals

The overall goal for all of the participating institutions was to procure up to 100% of each campus’ electricity from a renewable source while balancing cost, risk, environmental impact, and other strategic benefits.

Implementation

The process involved weekly core team calls, with regular updates to other senior decision-makers at key milestones.

The group decided to explore two solution types: 1) wholesale power purchase agreements (PPAs); and 2) structured retail. Wholesale PPAs are contracts between energy users (i.e. the campuses) and project owners, designed to attain several benefits of renewable energy without disrupting a campus’ existing electricity supply, whereas a “structured retail” agreemet replaces a campus’ existing electricity contract.

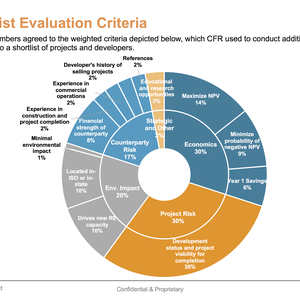

The group established scoring criteria for evaluating renewable energy bids, as depicted in the attached "pinwheel" graphic.

CustomerFirst Renewables (CFR) issued an RFP for the two renewable energy product types. Based on the more attractive economics, the group focused its attention on the PPA bids. CFR narrowed down 66 project bids to a shortlist based on estimated levelized savings (dollars saved per MWh over the life of the contract). Further analysis was conducted on the shortlist including: negative hour analysis, sensitivity analysis, supply curve analysis, Monte Carlo simulations, as well as project and developer due diligence.

The group conducted interviews with the list of several finalists, conducting in-depth developer due diligence, and requesting best-and-final-offers along a novel contract risk mitigation structure clause that would trade some upside economic benefit for some downside risk protection. Interviewed developers were also asked for a variety of education-related benefits, such as internships for students. CFR calculated the finalist scores using the criteria agreed on by the group, and recommended a selected project.

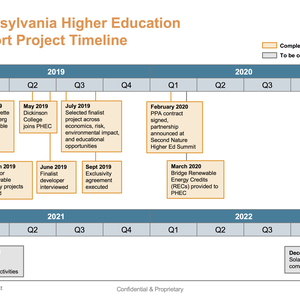

Timeline

Each participating institution started its journey on this process at different times, learning about and exploring renewable energy opportunities and participating in a variety of webinars, workshops, and cross-campus discussions. The exploration threads were formally sown together in January 2019 when Lehigh, Lafayette, and Muhlenberg agreed to formally collaborate on a competitive process seeking renewable energy bids, jointly using CustomerFirst Renewables as the group advisor. Several other campuses joined the process throughout the spring of 2019, including Dickinson, as well as three other campuses which opted out at different points for a variety of reasons.

In June, the cohort interviewed a list of finalists, and in July selected the final project, executing an exclusivity agreement, removing the project from the market, while the buyers and the developer negotiated contract terms and conditions in good faith. The initial 90 day exclusivity period was extended until final terms were agreed and contracts were signed in February 2020.

Please see the attached Timeline graphic for a visual illustration of key milestones.

Financing

PPAs are contracts that set an agreed price for electricity from a specific source for an agreed period of time. As such, they typically require no up-front capital expenditure. Once they have a customer, project owners are responsible for financing the construction and operation of the project. The only out-of-pocket expenses for the participating institutions were: a consulting fee to CustomerFirst Renewables as their advisor, a legal fee to an external energy counsel, and a fee to WattTime for calculating avoided emissions from the list of finalist projects. All three of these fees were shared among the schools, which was a significant financial benefit associated with aggregation.

The participating institutions expect to save at least several dollars per MWh, on a levelized basis, compared to their business-as-usual scenario. As an example, if an institution contracted 30,000 MWh per year, on a 15 year contract, and saves $5/MWh, the simple savings would be $150,000 per year.

Results

All four participating institutions executed power purchase agreements that will allow them to source 100% of their electricity from a 45.9 megawatt portion of a 200 megawatt solar project which will be constructed in a yet-to-be-announced location in Texas.

The project was selected after rigorous economic and risk analyses, as well as for avoided greenhouse gas emissions. Avoided GHGs became an important factor when they considered project location. On one hand, there was a preference for local projects, since they would be easier to visit and would benefit local air quality. However, “out of region” projects had much more attractive economics, and also tended to have greater greenhouse gas avoidance, based on modeling conducted by WattTime.

The best project in the PJM grid, where all of the campuses are located, had an emission factor of 1,072 lbs of CO2/MWh, whereas the best project in the ERCOT grid had an emissions factor of 1,240 lbs of CO2/MWh. In other words, the ERCOT project would avoid significantly more emissions than the PJM project. The ERCOT project is also expected to provide approximately twice as much cost savings as the best PJM project. Using the pre-agreed scoring formula, the cohort came to consensus and selected the final project, which is located in Texas. (At the time of this submission, the specific project has not yet been made public by the developer so confidentiality prevents it from being shared in this submission).

The successful execution of the deal was reported in the Philadelphia Inquirer here: (http://www.inquirer.com/business/lehigh-lafayette-muhlenberg-dickinson-sign-solar-supply-agreement-20200224.html)

Lessons Learned

Established relationships: Most of the participating institutions have a history of collaboration, so this cohort was built on established, trusting relationships.

Established Success Criteria: It was essential to agree on requirements versus preferences up front, particularly with regard to criteria for a successful renewable energy project. For example, some of the institutions that considered joining the cohort expressed strong preferences for a project located nearby. However, the founding members of the group had already agreed they were open to considering the pros and cons of projects across the U.S. The project that was ultimately selected is located in Texas, based on the strength of the economic benefits as well as the greater avoided greenhouse gas emissions compared to a project located in PJM. In the end, the preference for a local project, expressed by at least one potential participant, became a requirement and therefore that institution did not continue on with the group. Learning about the renewable energy market takes time, but the earlier the success criteria can be established, the better participants will be equipped to avoid dedicating time to a process designed to meet their goals.

Project Team: It was critical to involve all of the right stakeholders at the right junctures in the process. These included CFOs, legal counsel, accounting, facilities, sustainability, presidents, boards of directors, and purchasing. Some of the potential participants engaged one or more of these stakeholders too late in their process and it prevented them from participating in the solution.

External Advisors: We worked with CustomerFirst Renewables, an experienced renewable energy advisor with a long track record of assisting institutions of higher education. These advisors with indispensable in navigating the complex renewable energy market, engaging and aligning our stakeholders, and getting us the best deal, rather than just an acceptable deal.